This week I attended a lecture at the London School of Economics on what Economists should learn from the financial crisis. It was chaired by Mervyn King and included Ben Bernanke, Olivier Blanchard, Larry Summers and Axel Weber. Whilst many interesting matters were discussed, Blanchard in particular spoke of the importance of the financial sector in macroeconomic theory and policy. Prior to the crisis, he said, he assumed away the financial sector as an efficient system that he didn’t need to worry about. Obviously this turned out to be false, so he claimed that monitoring the financial sector and ensuring stability in this sector is now the ‘Third Leg’ of macroeconomic policymaking, to be considered alongside monetary and fiscal policy.

Given this, and despite the notion that QE is not a cause for concern at present , it is necessary to learn from the crisis and address how to monitor financial market stability. This gets very technical very quickly, but it’s an area that economists need to become a lot more familiar with.

The New York Federal Reserve lays out a framework

A recent staff report from the New York Federal Reserve, titled Financial Stability Monitoring, provided an excellent framework to look at this important issue. The NY Fed framework focuses on system wide vulnerabilities and how a shock would reverberate across the system. It is motivated by work on maturity mismatch , leverage and other amplification mechanisms. They articulate a stylised framework with the following assumptions:

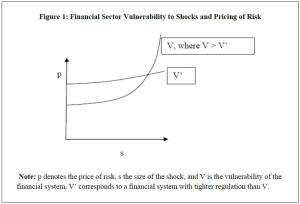

- The price of risk, p, increases with financial shocks, s.

- p is more sensitive to s when vulnerabilities, v, are high.

- When s is low, p is increasing in v.

These assumptions rely on the following intuitions. Firstly, regardless of vulnerabilities, the system wide price of risk increases with adverse shocks. Secondly, vulnerabilities such as leverage and maturity mismatch make it more likely that shocks will trigger investor runs and may cause the price of risk to rise sharply. Finally, when shocks are low, the benefits of a more vulnerable system is a lower price of risk, that is, it allows for cheaper financial intermediation. This is captured in the following diagram from the NY Fed paper:

The NY Fed paper discussed many aspects of the financial system that warrant monitoring and attention, but here I will just focus on a limited area and leave more interested readers to explore the paper in full. Of particular interest to me is that of asset markets, such as house prices or equity prices. The authors mention that it is not enough to focus on whether or not prices are overvalued, as these prices should be considered in the broader financial context. For example, the bursting of the dot com bubble did not have the same impact as the bursting of the housing bubble as it did not involve the over-leveraged balance sheets and maturity transformations that occurred during the housing bubble.

Similarly, they also discuss the non-financial sector as an area for monitoring. One example was the buildup in household debt and it’s subsequent negative impact on household spending, as discussed by Mian & Sufi .

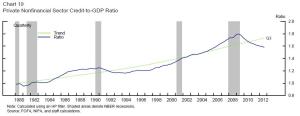

One chart of particular interest is their Chart 19 seen below. It is one indicator of private nonfinancial sector leverage. It shows the trend and actual ratio of nonfinancial sector credit to GDP. It clearly shows the above average growth of this ratio before the financial crisis, but it can be difficult to assess these ratios in real-time.

The remainder of the NY Fed paper is interesting reading about the pre-emptive policies to foster financial sector stability. Policies such as counter-cyclical capital buffers for systemically important institutions and loan-to-value ratios for the nonfinancial sector are discussed.

The considerations of Stein

In a much discussed speech, Jeremy Stein, member of the Federal Reserve Board of Governors, also addressed the issue of financial stability by looking at what factors lead to overheating in the credit markets. Stein focuses on the pricing of credit and the crucial roles of institutions and incentives. Whilst he recognises the role of beliefs and expectations in the household sector, he views the roles of agents in the financial sector as highly relevant to the pricing of credit.

He outlines three factors that contribute to overheating. Firstly, he states that financial innovation can create new ways for ‘agents to write puts that are not captured by existing rules.’ Secondly, related to his first point, he notes that new regulation also creates incentives for new innovation to get around these rules. Finally, related more to the macro-economy, he discusses that changes in the broader economy that alter the risk taking incentives of agents making credit related decisions.

Stein then discusses various pieces of current day evidence that he believes shows a ‘reach for yield’ in the financial sector. While this is important, I wanted to focus on a more hypothetical example that he discusses as it highlights the complex interplay between monetary policy and financial stability policy.

Before discussing this example, Stein outlines his reasons why monetary policy should be a part of financial market stability policy and not just restrict itself to the dual mandate. Firstly, our current macro-prudential and regulatory frameworks are imperfect. Secondly, monetary policy may be a blunt tool, but it get into ‘the cracks’ more than targeted regulation can. Finally, monetary policy is more than the interest rate tool, in particular, the ‘Maturity Extension Program’ (MEP, also referred to as Operation Twist) showed how the Fed can shape long term rates and the yield curve itself.

This leads to a pertinent example of what a future policy mix might look like. Using the example of the issue of maturity transformation, he outlines a situation where agents are transforming shorter funded general collateral repo for longer funded mortgage backed securities. Moreover, the dual mandate is calling for an easing of monetary policy which would exacerbate the incentive for this maturity transformation. In this scenario, Stein suggests a policy mix of lowering short term rates to satisfy the easing required for the broader economy, while at the same time conducing something like Operation Twist to flatten the yield curve and reduce the incentive for maturity transformation.

There is no doubt that these issues are difficult to get to grips with and some, like Axel Weber, believe that Central Banks should not be charged with financial market stability. What does seem clear from the financial crisis, however, is that the Third Leg of macro economic policymaking is here to stay.

Pingback: Disequilibrium Economics: the ISLM Model | globalmacromatters